The magic number in 2018 was around 4.8%. In 2006, it was about 6%. But with today’s home prices? Here are the signs.

by Wolf Richter about Wolf Street.

The average weekly interest rate for 30-year fixed-rate mortgages with matching loan balances rose to 4.06% for the week ending February 18, the second consecutive week above 4%, and the highest since July 2019, according to Mortgage. Bankers Association Today. The average rate of 30-year fixed-rate mortgages backed by FHA increased to 4.09%.

So where is the magic number beyond which this highly bloated housing market begins to feel the pressure of high mortgage rates?

But mortgage rates are still ridiculously low, in the face of CPI inflation that has jumped to 7.5% and is now still Fueled by continued interest rate suppression from the Federal Reserve and quantitative easing – making that Most reckless Fed ever.

The “magic number” in 2018.

In the fall of 2018, with mortgage rates heading toward 5%, the housing market began to crash, and stocks were headed lower. The magic number at the time seemed to be around 4.8%, and when mortgage rates moved higher than in September, everything started to fall apart.

After the S&P 500 fell about 20% by December 24, 2018, and with the housing market weakening, Fed Chairman Powell succumbed to Trump’s daily hammer and did the now infamous turn.

However, at that time in early 2019, inflation was less The Fed’s target, as measured by the “core PCE” yard stick, is at 1.6%, which gave Powell a fig leaf.

Now inflation is the worst in 40 years and surging higher, and Inflated ‘basic personal consumption expenditures’ is 2.5 times The goal of the Federal Reserve. It’s inflation now that’s beating Powell on a daily basis – he’s made a fool of himself calling this monster he unleashed “temporarily” when everyone already knew he was going to escalate to a higher level.

So where is the magic number this time after which the housing market begins to feel the pressure?

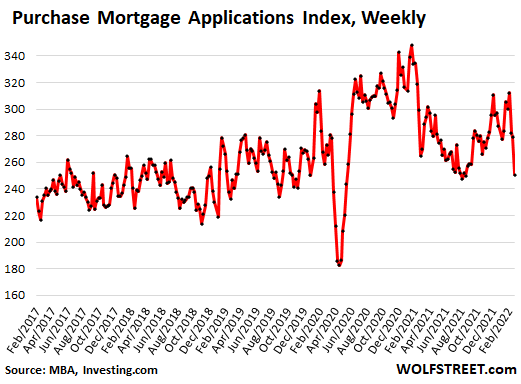

Mortgage requests to buy a home fell sharply for three consecutive weeks, coinciding with the rise in mortgage rates, and in the week ending February 18, they reached their lowest levels for a brief period in August 2021, and then during the closing period, to enter the bottom. From range in 2019. The MBA Mortgage Applications Index has fallen 28% from pandemic highs in January 2021 (data via Investing.com):

“The Magic Number” 2006.

Not shown in the chart: Back at the peak of the housing bubble 1, in January 2005, the MBA’s Buy-Mortgage Index reached 500 – twice today’s level – before collapsing.

At the time, the Fed was in the middle of a rate-raising cycle, raising the fed funds rate from 1.0% in June 2004 to eventually 5.25% by July 2006, pushing the average 30-year fixed-mortgage rate to 6.4%. At that time, the housing market began very slowly to collapse.

The Nasdaq index started trending lower in the summer of 2007, and little by little everything exploded in a global way, punctuated by the Lehman crash in September 2008.

High mortgage rates, when home prices are already high, are very challenging in the housing markets. And higher interest rates are generally harsh on stocks.

So where was the magic number at that time? Apparently 6.4% for a 30-year fixed rate mortgage, at bubble 1 housing prices, was above the magic number.

Mortgage applications decline.

Rising mortgage rates mean that families are putting refinancing their mortgage loans into trouble. This is happening despite the historic explosion in home prices that brings with it a lot of real estate equity that can be extracted with a cash-drawing reference.

The MBA Mortgage Refinance Applications Index has fallen to its lowest since June 2019 and is 74% off epidemic highs — mortgage rates are just beginning to rise and are still ridiculously low, given that CPI inflation has soared. To 7.5% (data via Investing.com):

The magic number now.

First-time homebuyers, facing high mortgage rates and rising prices, have already pulled out of this ridiculously bloated market by the Federal Reserve, as investors and cash buyers piled into the market.

In January, first-time buyers fell to just 27% of total home purchases, down from 30% in December, and down from 34% in all of 2021, according to the National Association of Realtors.

Going forward, “some middle-income buyers who barely qualified for a mortgage when interest rates were low, now won’t be able to afford a mortgage,” NAR said.

With every increase in home prices, and with every increase in mortgage rates, more layers of potential buyers are wiped off the table. At first no one noticed, but then the layers began to pile up, and at some point, ordinary buyers – like first-time buyers – began to weaken. This is what we see now.

At first, cash buyers and investors may be able to make up the difference. This is what happened during the “Housing Bubble 1” period, which was driven in part by investors, who then became the core of the mortgage crisis when they moved away from many properties at once.

Individual investors, or second-home buyers, piled into the market, and made up 22% of home purchases in January, up from 17% in December, and up 15% in January last year, according to NAR.

All cash purchases jumped to 27% of home purchases in January, up from 23% in December and from 19% in January 2021, according to a NAR report.

But in January, mortgage rates were still in the 3.5% to 3.7% range, well below the 4% line. Indeed, visible layers of first-time buyers are beginning to exit a market artificially inflated by the Fed’s reckless monetary policies, which are now facing rising but still artificially low mortgage rates.

So the magic number now for the average 30-year fixed-rate mortgage appears to be a little north of 4%, the level at which layers of potential buyers, like first-time buyers, disappear from the market. This is already happening.

For now, as last time, enthusiastic investors are making the difference, but if we learn anything from the disaster 15 years ago, that investor enthusiasm will also wane in these ridiculously inflated markets when interest rates rise in the face of rising home prices. As is the case in America’s most luxurious housing bubbles:

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”