There is some demand destruction. But oil bounced back again, gasoline might be next. My guess is a long-running zigzag spike.

by Wolf Richter to Wolf Street.

After the staggering rise in gasoline prices, the question arises when demand will start to be destroyed, as people start to drive less, start making it easier to conserve gas when they drive, or start prioritizing the more economical car in their garage. If enough people do that, demand begins to fall, and gas stations have to compete for dwindling business. Destruction of demand is what may cause the price to fall again. Have we arrived?

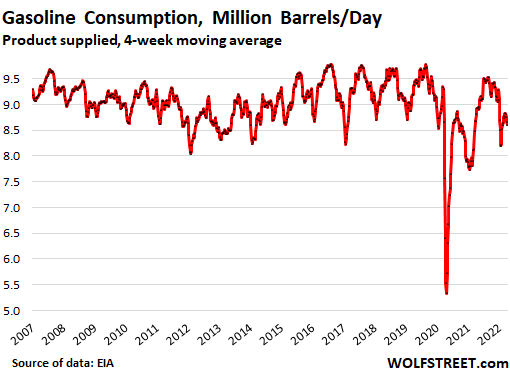

The Department of Energy’s Environmental Impact Assessment measures gasoline consumption in terms of barrels supplied to the market by refineries, mixers, etc., rather than through retail sales at gas stations. Gasoline supplies fell for the third consecutive week. This is unusual at this time of year, when gasoline consumption usually rises during the summer.

The Energy Information Administration said Thursday that gasoline consumption fell to 8.61 million barrels per day in the week ending April 8 based on a four-week moving average (red line), the lowest since March 4, down 2.3% from the same period in 2021 (line black) and decreased by 8.1% from the same period in 2019 (gray line).

Consumers started responding in January.

Notice how the past 11 months (red line) closely tracked the pre-Covid period three years ago (gray line) until they began to diverge sharply, not only in March, but already in mid-January, and have been below the 2019 level since then. .

Gasoline prices began to rise from collapsed levels in April 2020. By May 2021, the average price of gasoline, in all grades combined, exceeded $3.00 a gallon, a multi-year high, and has continued to rise. In November 2021 it hit $3.40 a gallon and took a breather. Then in early February, it began to rise higher and in Historic jumps reached $4.32 on March 14.

But since mid-March, the price has fallen. Now at $4.09, the nosebleed is still high but slightly lower than it used to be:

Gas stations don’t cut prices out of the goodness of their hearts. They are lowering prices because sales are hurting, and price competition has broken out between gas stations in an effort to maintain sales. Gas stations can lower their selling price without affecting their profit margins while also lowering the costs of their products.

The demand destruction for gasoline then moves to the demand for crude oil. But crude oil has much wider uses than just gasoline, including the burgeoning petrochemical industry. A small drop in US gasoline demand will not shake the global crude oil markets much.

The price of Crude Oil has already rebounded again.

West Texas Intermediate crude rose to $130 a barrel and then fell back to the mid-$90 range. In recent days, it has changed course again and is now at $106. This is not a good sign of gasoline prices.

There has obviously been some destruction in demand, and that may have been enough to cause the price of gasoline to drop a bit.

But maybe it wasn’t. Perhaps this destruction of demand was not the reason for the drop in gasoline prices. Perhaps they fell for another reason, like the current fluctuations that hit everything. The unbridled dynamics of commodity markets ensure that.

My guess: gas prices will go up again.

I can see a collapse in demand, but for now I’m still skeptical that it’s big enough to cause a permanent drop in the price of gasoline. I wouldn’t be surprised if the price starts heading higher again. Crude oil prices have already started to rise again. This could be a long term process where prices are very volatile and zigzag higher and higher. This is my guess.

what we know.

Annual gasoline consumption peaked in 2007 It then declined over the next five years to 2012 by a total of 6.3%. Then it rose again, reaching the 2007 peak again in 2016, again in 2017, 2018, and again in 2019, without surpassing it. Then in 2020, consumption collapsed. In 2021 consumption recovered sharply, but annual total consumption ended the year still 5.3% lower than 2007!

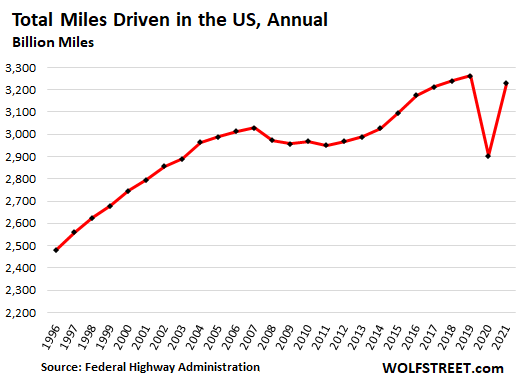

But the total car mileage set a record every year From 2015 through 2019. And in 2021, despite a crash in 2020, miles are up 6.6% from 2007. People drive more, but use less gasoline to do so:

Therefore, there are many other factors that play a role in gasoline consumptionAnd not just the price. This includes long-term technology trends, such as more fuel-efficient cars, and the arrival of electric vehicles on a scale that is now large enough to make an impact on gasoline consumption.

Other changes also affect gasoline consumption, some of which date back well over a decade, such as the construction boom of high-rise apartment towers in urban centers that reduced or eliminated car commuting for residents; Or the trend of working from home at least part-time that also cuts passenger miles.

The opposite trend has been the increase in driving leave during the pandemic, which may now have been replaced by flying again (local leisure traffic has risen).

Gasoline consumption is also highly seasonal, which makes it difficult to determine where price-demand destruction occurs, and where unusual seasonal patterns can play out.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”