Suddenly the pent-up display appears – those vacant homes that no one would have considered vacant.

by Wolf Richter for Wolf Street.

Over the past two years, the story has been that there is no inventory to sell, that there is a housing shortage, which is why prices have been going up. Then there were other people like me who pointed out over and over again that people didn’t put their old homes on the market after they bought a new one, that these people now own two or three homes and that they’re going to ride the hottest real estate market ever with prices up 20% or 30% or more annually, and then they sell those vacant homes that no one has ever considered vacant.

And because they were already living in a house, they could sell their empty homes without having to buy another one. This is the “shadow stock” that is now coming into the market, just when mortgage rates have gone up, and sales are going down. And to get things moving, the price cuts are skyrocketing.

Suppressed supply, declining sales: It’s just the beginning, but it’s happening.

Active menus jumped In June it was up 20% compared to May, and up 19% from last year, which is the second consecutive annual increase after a jump of 8% in May, both of which were the first annual increases since June 2019. There were about 98,000 people more Homes for sale in June compared to last year, according to data from the National Association of Realtors today (data in realtor.com):

Active listings jumped for two reasons:

Sales of ONE, pending in June, fell 16% year-on-yearAfter a 12% drop in May, and a 9% drop in April, potential buyers lost interest in rising home prices and mortgage rates. These are listings at various stages of the sale process, but before the deal is closed. June was the tenth consecutive month of year-over-year declines. Back in June, NAR reported that “Closed sales fell in May for the tenth month in a row. This does not bode well for closed sales in June:

Two, new listings went up in June to 562,000 homes, the second highest level in June in recent years, after only June 2019. And interestingly, the new menus rose in june, when in normal years it peaked in May and decreased in June. I rotated previous Junes (data via realtor.com).

Price cuts soared by 50% in June from May and about weakness On a yearly basis, as sellers try to get buyers to show up and take a look as foot traffic has plummeted and bid wars have regressed into fond memories. This is a sudden reset. But more sellers are dealing with a new reality: prices have to go where the buyers are, and the buyers are somewhere, but much lower (data via realtor.com):

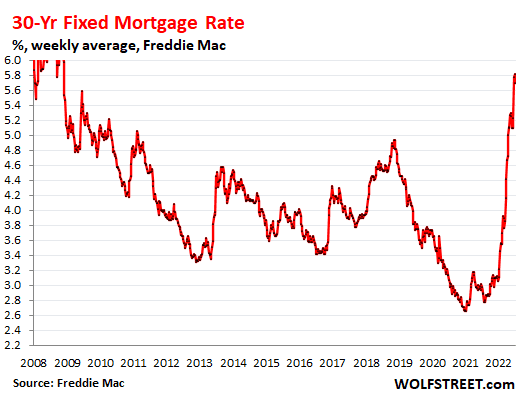

Holy Mortgage Rates – so called because that’s what people say when they first see the mortgage payment for a home they want to buy – hovering around 6% for a 30-year fixed mortgage, double what they were in 2020 (data via realtor.com) .

These kind of mortgage rates, having doubled not so long ago, and home prices that have gone up 40% or more over the same two-year period are a bad combination. Something has to offer, and it won’t be the buyers – because they can’t, they are trapped – but the sellers. Or there is no agreement.

and buyers who could They buy, famous cash buyers, they don’t want Buy at these prices too, now that the madness is starting to come out of the market. Nobody wanted to overpay at the height of the frenzy for what was a completely insane market.

Big difference in listings between the 50 largest metro areas.

Among the 50 largest metro areas, the number of active listings in June rose the most in Austin (+144% year over year), Phoenix (+113%), and Raleigh (112%). In 31 other central regions, active listings rose in double digits. Active listings decreased in only a few central areas, led by Chicago (-13%), Virginia Beach (-14%) and Miami (-16%).

The table is sorted by annual percentage change of active lists (data via realtor.com):

| The largest metro areas, active ads, June 2022 | Percentage change year on year |

| Austin-Round Rock, Texas | 144% |

| Phoenix Mesa Scottsdale, Arizona | 113% |

| Raleigh, North Carolina | 112% |

| Salt Lake City, Utah | 98% |

| Nashville Davidson – Murfreesboro – Franklin, Tennessee | 86% |

| Riverside-San Bernardino-Ontario, California | 72% |

| Seattle Tacoma Bellevue, Washington | 66% |

| Sacramento – Roseville – Arden – Arcade, California | 65% |

| Dallas Fort Worth Arlington, Texas | 62% |

| Denver Aurora Lakewood, Colorado | 58% |

| Tampa St. St Petersburg Clearwater, Florida | 56% |

| Tucson, Arizona | 55% |

| San Antonio – New Braunfels, Texas | 54% |

| San Francisco-Oakland-Hayward, California | 46% |

| Las Vegas Henderson Paradise, Nevada | 45% |

| Jacksonville, Florida | 38% |

| Oklahoma City, okay | 37% |

| Charlotte Concord Gastonia, North Carolina | 37% |

| San Jose, Sunnyvale, Santa Clara, California | 34% |

| Memphis, Fig.- MS-AR | 33% |

| Orlando Kissimmee Sanford, Florida | 31% |

| Portland Vancouver Hillsboro, Oregon, Washington | 31% |

| Kansas City, Missouri | 28% |

| Birmingham Hoover, AL | 26% |

| San Diego Carlsbad, California | 25% |

| Atlanta Sandy Springs – Roswell, Georgia | 23% |

| Indianapolis-Carmel-Anderson, IN | 22% |

| Louisville/Jefferson County, Kentucky | 22% |

| Los Angeles Long Beach – Anaheim, California | 20% |

| Detroit Warren Dearborn, Michigan | 18% |

| New Orleans-Metairie, Los Angeles | 16% |

| Buffalo Chictoaga Niagara Falls, New York | 13% |

| Columbus, Ohio | 12% |

| Houston-The Woodlands-Sugar Land, Texas | 10% |

| Providence Warwick, RI-MA | 6% |

| St. Louis, Missouri-IL | 5% |

| Cincinnati, oh-ki-in | 5% |

| Pittsburgh, Pennsylvania | 4% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 2% |

| Baltimore Columbia Towson, MD | 1% |

| Boston-Cambridge-Newton, MA-NH | 0% |

| New York – Newark – Jersey City, New York – New Jersey – Pennsylvania | 0% |

| Minneapolis St. Paul Bloomington, Minnesota, Wisconsin | 0% |

| Cleveland Illyria, Ohio | -2% |

| Philadelphia Camden Wilmington, PA-NJ-DE-MD | -2% |

| Rochester, New York | -4% |

| Milwaukee-Waukisha-West Alice, Wisconsin | -4% |

| Richmond, Virginia | -6% |

| Chicago Naperville Elgin, IL-IN-WI | -13% |

| Virginia Beach – Norfolk – Newport News, Virginia, North Carolina | -14% |

| Miami, Fort Lauderdale, West Palm Beach, Florida | -16% |

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”